Telling Africa's Growth Story part 2

TECHNOLOGY APPROPRIATION: Acquisition + Innovation

After Connectivity in it multiple forms, Technology is the second core pillar of African growth. Here the African specificity lies in harnessing modern technologies for development through both acquisition from abroad and domestic innovation. This African technology appropriation is combining with rising African incomes and rising African demography (2 billion people by 2035, possibly 4 billion in 2050) to produce a ‘wag the dog’ phenomenon: the norms, trends and new products designed in African markets for African consumers are increasingly becoming the norms, trends and new products of global markets, including of Developed Markets (DMs).

Africa’s cellphone revolution

Cellphones are the most famous example of African technology acquisition and its resulting leapfrog. But the systemic and global nature of African innovation with cellphones and mobile services is often neglected: indeed after first adopting foreign manufactured cellphones (predominantly Nokia and Motorola in the early 2000s) Africans moved on to not only manufacturing cellphones locally but also along the way using mobiles for other functions and sectors: in agriculture, smallholders began to cut many intermediaries out of their supply chains to have the closest access possible to global spot market prices. This trend has now extended to the rise of agro-commodities powered by blockchain and Distributed Ledger Technology (DLT) which brings together smallholder producers, international purchasers and distributors, agriculture equipment manufacturers and banks.

African e-commerce

A similar revolution happened in Fast Moving Consumer Goods (FMCG), starting with retailers and wholesalers comparing prices instantly between domestic, regional and international markets, and negotiating the best terms; then with smartphones, the explosion of online retail and e-commerce platforms across African countries with among others Souq in Egypt, South Africa’s Takealot, Konga in Nigeria, Cameroon’s BEE Group or Jumia rivaling Amazon domestically.

Cellphones and smartphones have also turbo-charged the creation of new start-ups and venture capital in other sectors: ride-hailing apps with the likes of Little Cab (Kenya), SafeBoda (Nigeria), Hoja (DRC) or Mboa Taxi (Cameroon) who are rivaling Uber and Bolt on the continent; in payment apps and platforms, Flutterwave the largest African unicorn is the standard bearer of a pan-African tidal wave of payments platform start-ups which are the continent’s largest draw of venture capital and set for revenues of US$40bn by 2025.

African fintech

In the financial sector, the onset of mobiles made the attending financial flows of all this activity visible to a wider range of stakeholders locally and globally, which led to the Mobile Money boom, started in Kenya, by Kenyans for Kenyans, and still dominated by them to this day. Then with the advent of smartphones, this led to Africa leading the global digital financial services market, with 10% annual growth and revenues of US$230bn by 2025. It’s against this backdrop that Central Bank Digital Currencies (CBDCs) are taking off in Africa.

The rise of the African ‘everything’ apps

The business segments: e-commerce platforms, ride-hailing apps, payments platforms and fintech- are increasingly offered as common packages in a competitive urban tech eco-system that is increasingly integrated across Africa. The looming next step in these offers are pan-African super-apps or ‘everything apps’ on the model of WeChat in China, such as Gozem, Okoda or Ayoba.

Africa’s Space Industry

The space industry is also being redefined by its appropriation in African markets: with 15 African countries having launched and often manufactured their own satellites (Zimbabwe and Uganda being the latest in 2022), a US$20bn value chain throughout the continent, and now an African Space Agency (AfSA) organizing the sector at the continental level, the African space industry is growing ever faster and come 2023 will include rocket and satellite launch systems in Somalia and soon after Djibouti too. Out of the 54 African satellites launched, 20 were in the last 5 years, with another 114 coming before 2025.

There are multiple and interrelated causes to this parabolic growth.

First, African nations are putting space technology to work for African development, such as land use and management, agriculture, weather and climate monitoring, mineral surveys, disaster management, but also continental air and rail transport grids.

Secondly, most African satellites in orbit are nanosatellites costing US$500,000 each or less, which makes them a great entry point into the space sector in the short term, and in the long term, into the connecting high-tech industries and skills (computer engineering, ICT, aeronautics, robotics, etc) necessary to climb up the global value chains of the Fourth Industrial Revolution (4IR).

Finally, African satellites are also active in supporting security for maritime and land borders, and in tracking and defeating terrorist groups and insurgencies. Rwanda has become the first in Africa to initiate the next phase, as it plans to launch and operate a mega-constellation of up to hundreds of thousands of satellites.

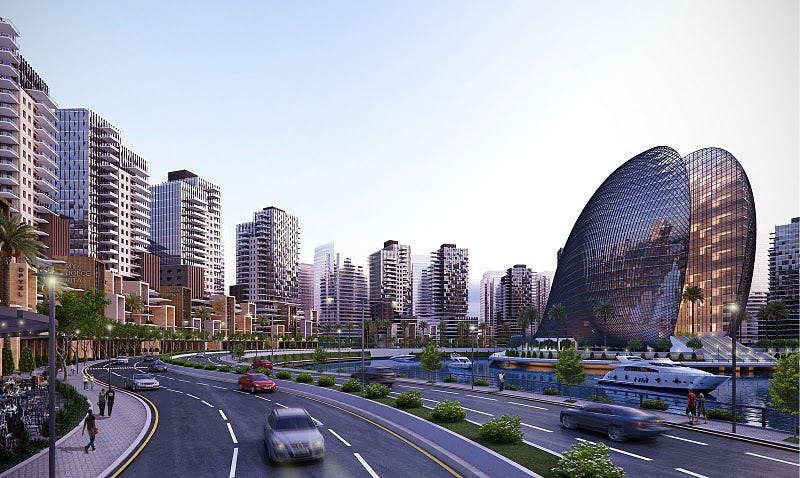

Smart Cities

Smart cities are another emerging and still largely unnoticed ‘wag the dog’ story from Africa, as points of convergence for the trends of infrastructure rollout, urbanization, industrialization, technology appropriation and sustainability on the continent, and thus setting global norms.

Rwanda’s Green City Kigali Project is the first modern African urban community organized on sustainability principles from the outset, including local recyclable materials, affordable housing, green tech and renewable energy. The pilot phase launched in 2022 has earned Rwanda major international partners. Another smart city project on the continent emphasizing sustainability is Gambia’s TAF City, being led by the privately owned TAF Africa Global, and whose first phase, Benna Estate, is completed. TAF Africa Global is operating in seven additional African countries and the company aims to build 1 million affordable homes by 2040 throughout the continent.

Kenya’s Konza City, though also strongly integrating sustainability, is designed to harness technology both to become Kenya’s main tech hub and to drive the whole Kenyan economy’s digital transformation. At the same time, the Mwale Medical and Technology City (MMTC) in Western Kenya is already proof of concept for sustainable smart cities in the country: built for US$2bn by Julius Mwale, the Kenyan who invented online biometric online verification, the smart city with 35,000 residents is centered around a large 5,000 patient capacity Hamptons Hospital and also includes an innovation and research park, an industrial district powered by a solar power plant, a commercial center with malls, an airport, as well as a tourism circuit with a 36-hole golf course and a convention center. MMTC is also owned by the local community of Butere and provides free medical care to the 2 million residents of its local Kakamega county.

For its part, Zimbabwe’s recently started Zim Cyber City is meant to propel ICT, blockchain services and the digital economy, in order to anchor the New Harare City Project, set to create a new capital and industrial hub. Egypt, fresh from completing the first phase of their New Administrative Capital is sharing with Zimbabwe its acquired experience and providing technical support.

Diamniadio Lake City in Senegal may be the most advanced smart city south of the Sahara: with an operating industrial park already exporting textile and construction materials, a commuter train station, a data center and a Sports City with an Olympic stadium. The blossoming new city is already emerging as an industrial and tech hub boosting Senegal’s growth and development.

Other ongoing African smart city projects include Nigeria’s Eko Atlantic City, Wakanda City of Return in Ghana, Bahir Dar City in Ethiopia, Lanseria, Durban Aerotropolis and Mooikloof mega-city in South Africa, CAR’s ‘Sango’ Crypto City, Akon City in Senegal and Uganda, among many others.